Nevada law gives you a limited time to file a car accident claim in Las Vegas. You have two years from the date of the accident to pursue a personal injury lawsuit and three years to recover for property damage. These deadlines, also known as statutes of limitations, determine whether you can seek compensation at all.

If you wait beyond 24 months to file an injury claim or past 36 months for vehicle losses, the court will bar your case regardless of the evidence. Insurers understand these rules and often delay negotiations, hoping victims run out of time.

The legal clock usually starts on the crash date or when the injury occurred. Acting quickly with a Las Vegas car accident attorney ensures your claim is filed before time expires, evidence is preserved, and your right to compensation is fully protected.

Recent Case Result

We secured a $5 Million settlement for a client injured in a car crash.

Our legal team fought to recover full compensation for medical expenses, lost wages, and pain and suffering.

Call Us Now: (702) 333-4223How Long After an Accident Can You File a Claim for Car Accidents in Nevada?

Most car accident victims in Nevada have two years to file a personal injury lawsuit in civil court. This deadline applies to the majority of crashes involving injuries, making it absolutely critical to know when the clock starts.

When Does the Statute of Limitations Begin?

For most cases, the statute of limitations begins on the date of the accident. In rare situations, courts may adjust this if an injury wasn’t immediately discoverable or if another legal factor delays filing. Common legal triggers include:

- Date of the crash causing injury

- Date of death in wrongful death cases

- Date a hidden injury is reasonably discovered

- Date legal capacity is restored for incapacitated victims

Time Limits for Filing Lawsuits, Not Insurance Claims

The statute of limitations governs lawsuits, not insurance claims. Insurers often require immediate notice, and waiting too long can result in a denial, even if you’re still within Nevada’s lawsuit deadline.

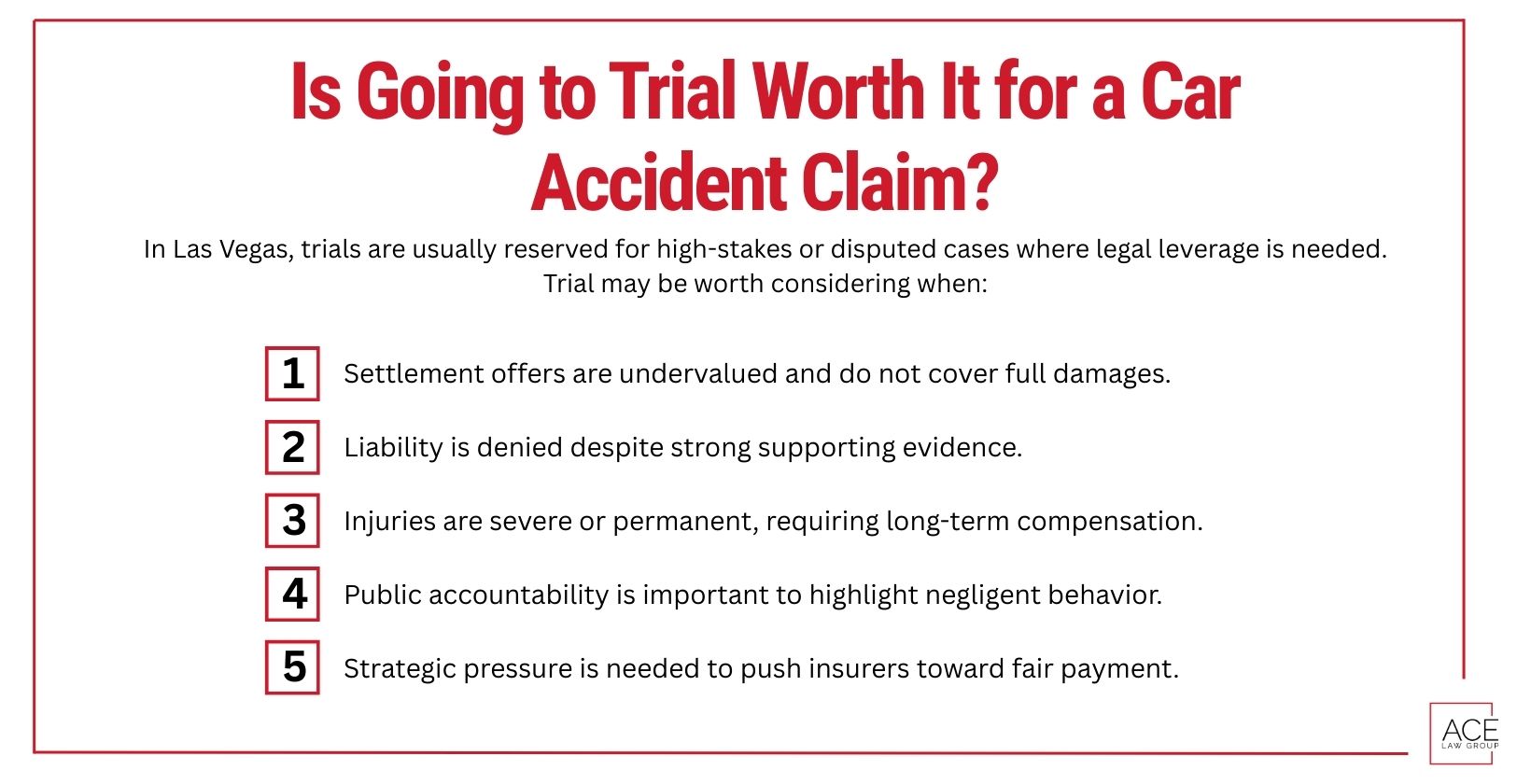

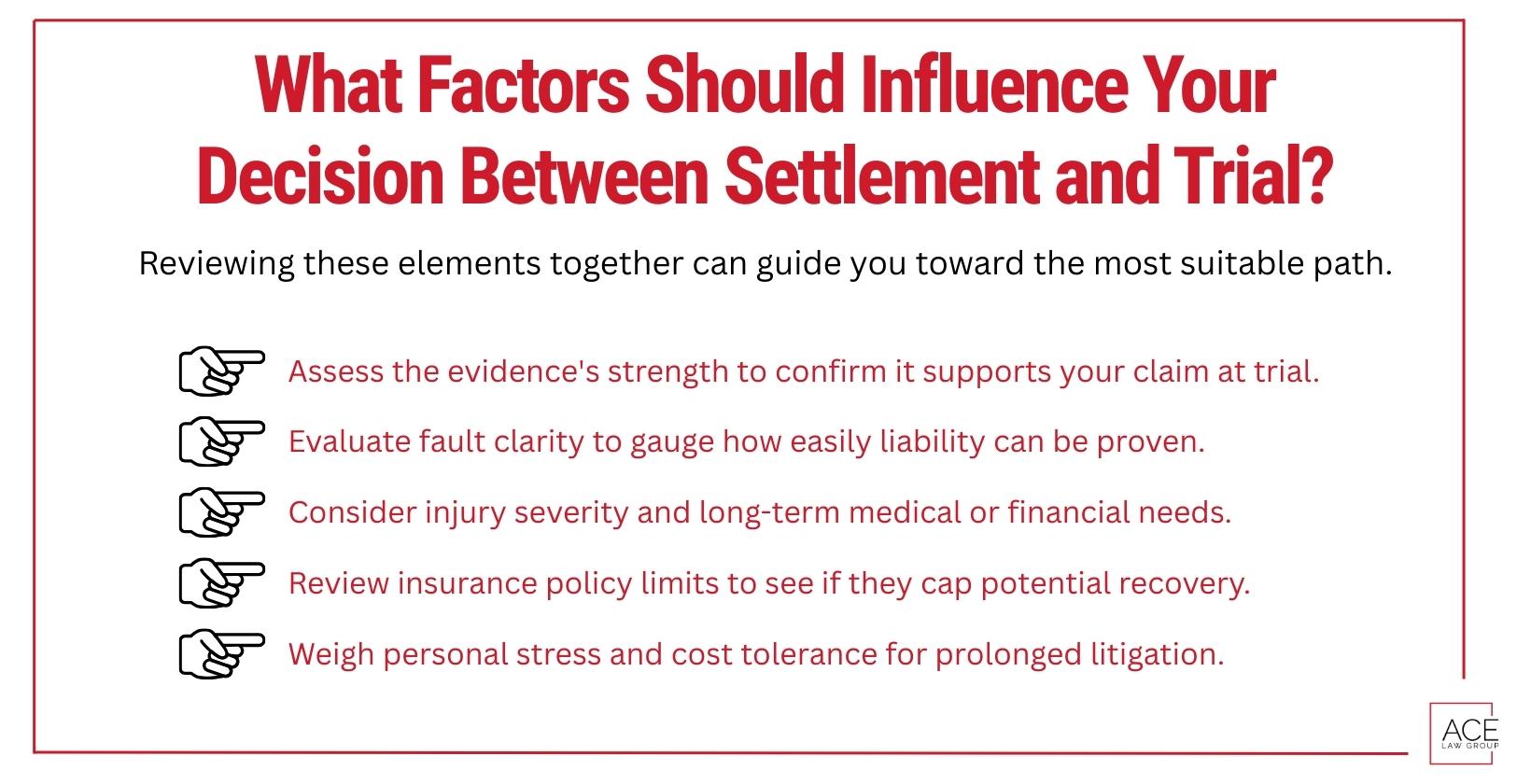

- Provides faster compensation without lengthy court proceedings

- Reduces legal and financial costs compared to litigation

- Delivers predictable outcomes through negotiated agreements

- Keeps case details private instead of public record

- Lowers emotional stress by avoiding the pressures of trial.

Time Limits for Filing Lawsuits, Not Insurance Claims

The statute of limitations governs lawsuits, not insurance claims. Insurers often require immediate notice, and waiting too long can result in a denial, even if you’re still within Nevada’s lawsuit deadline.

| Process | What It Covers | Deadline |

|---|---|---|

| Lawsuit | Filing in the Nevada civil court | 2 years for injury, 3 years for property damage |

| Insurance Claim | Reporting to your own or another driver’s insurer | “Prompt notice” (varies by policy, often days or weeks) |

Failing to meet either requirement can cost you compensation, even when liability is clear.

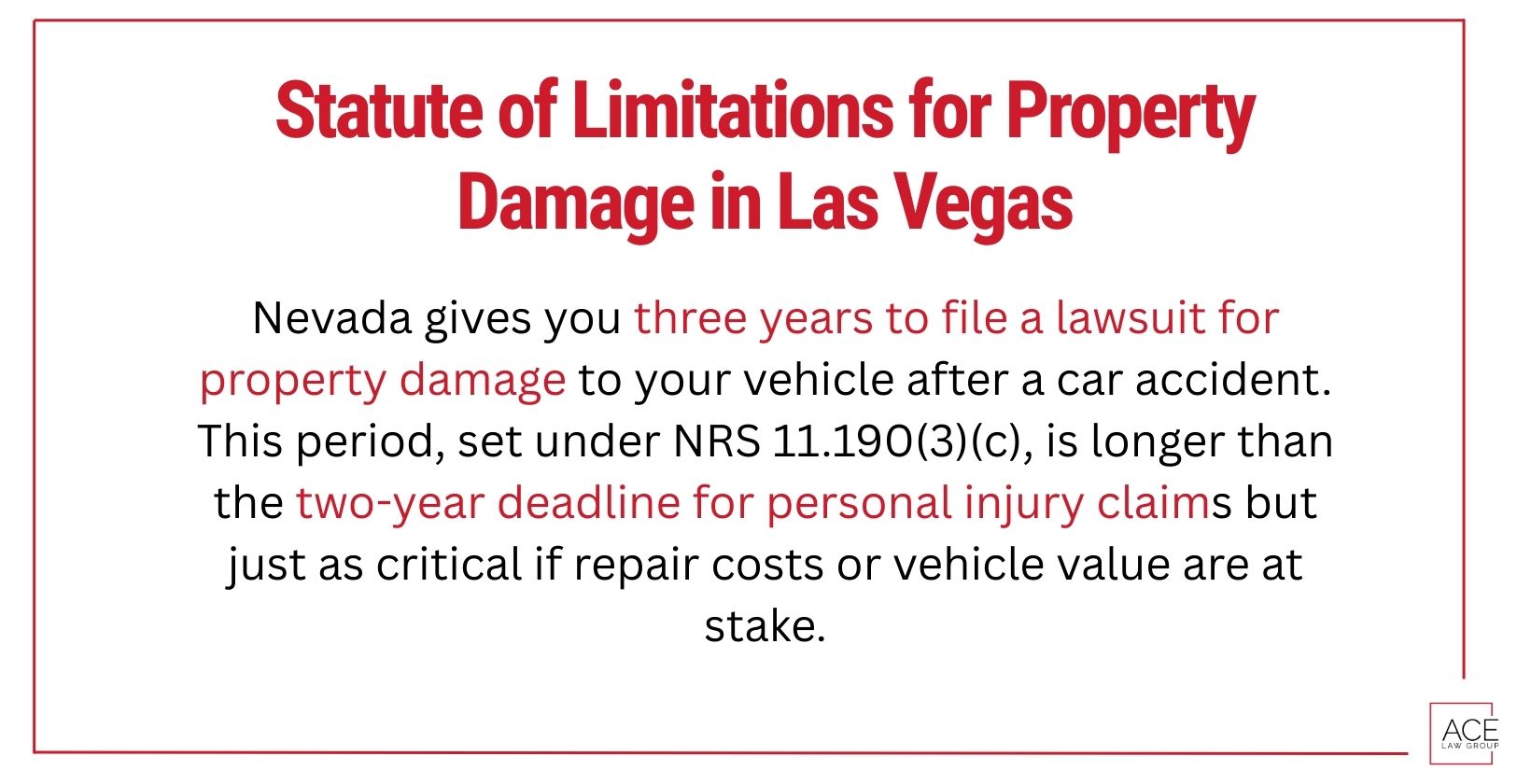

Statute of Limitations for Property Damage in Las Vegas

Nevada gives you three years to file a lawsuit for property damage to your vehicle after a car accident. This period, set under NRS 11.190(3)(c), is longer than the two-year deadline for personal injury claims but just as critical if repair costs or vehicle value are at stake.

Timeframe to Recover Vehicle Repair or Replacement Costs

The three-year statute covers every type of property damage claim tied to a crash, including:

- Repair claims supported by shop invoices or estimates

- Total loss claims based on pre-accident market value

- Diminished value claims when a repaired car loses resale worth

Even if insurers handle part of the process quickly, the full right to bring a lawsuit remains open for three years.

Proof Requirements for Property Loss Claims

Courts and insurers decide the value of a property damage claim by examining reliable documentation. The most persuasive evidence often includes:

- Photos of the vehicle and the accident scene taken promptly

- Repair invoices or detailed estimates from qualified shops

- Certified appraisals or depreciation reports

- Official police accident reports

Collecting these records early prevents disputes and ensures your losses are fully recognized. Waiting too long risks missing key proof, which can weaken or reduce your claim.

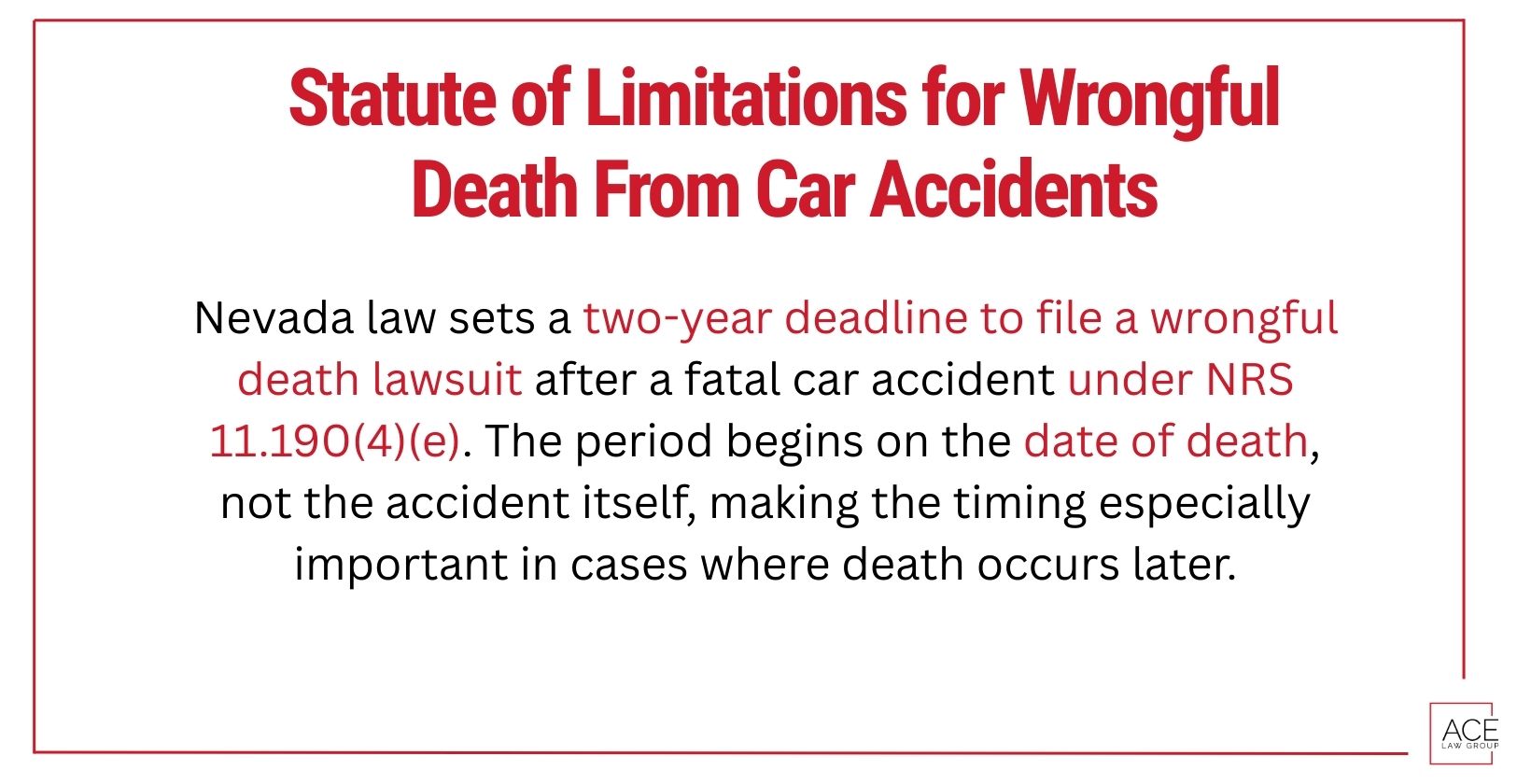

Statute of Limitations for Wrongful Death From Car Accidents

Nevada law sets a two-year deadline to file a wrongful death lawsuit after a fatal car accident under NRS 11.190(4)(e). The period begins on the date of death, not the accident itself, making the timing especially important in cases where death occurs later.

Definition of Wrongful Death Under Nevada Law

A wrongful death occurs when someone’s negligence or unlawful actions cause another person’s death. In traffic cases, this includes accidents involving reckless driving, intoxication, or traffic law violations. Claims cover both economic losses, such as funeral or medical costs, and non-economic harms like loss of companionship or support.

Who Can File a Wrongful Death Claim in Nevada

Nevada law limits wrongful death claims to specific parties. Eligible filers include:

- A surviving spouse or domestic partner

- The decedent’s children

- The parents, if no spouse or children exist

- A court-appointed representative of the estate

If more than one party qualifies, the court decides how compensation is divided, often based on each person’s relationship to the deceased and their proven losses.

The two-year timeline begins on the date of death, confirmed through records such as a death certificate or coroner’s report.

Legal Exceptions to Nevada’s Filing Deadlines

Nevada law enforces strict filing deadlines, but certain tolling provisions may pause or extend the clock. These exceptions apply only in narrow situations, such as when the victim is a minor, legally incapacitated, misled by fraud, or unable to identify a hit-and-run driver.

Tolling for Minors and Legally Incapacitated Persons

For minors injured in a crash, the two-year statute of limitations does not begin until they turn 18. This gives them until age 20 to bring a personal injury claim, though a parent or guardian can file earlier on their behalf.

If an adult is mentally incapacitated after an accident, the filing period pauses until they regain capacity or a court-appointed representative is authorized to act. This safeguard ensures claims are not lost due to incapacity.

Delays Caused by Fraud or Concealment

Tolling also applies when a defendant actively prevents a claim through fraud or concealment. Courts recognize concealment when someone deliberately hides key facts, such as:

- Using false identity information

- Withholding insurance or ownership records

- Misrepresenting fault in official reports

- Without clear evidence of intentional misconduct, however, courts rarely excuse a late filing.

Time Limit Extensions in Hit-and-Run Cases

In hit-and-run crashes, the statute of limitations may pause until the responsible driver is identified. Tolling often depends on factors like:

- The driver’s identity remaining unknown

- Law enforcement delays in locating the offender

- Evidence from insurers revealing the liable party

If the driver is never found, victims may pursue uninsured motorist coverage, subject to the deadlines written into their insurance policy.

Common Mistakes That Jeopardize Your Right to Compensation

Simple filing errors often cause car accident victims to lose valid claims. Avoid these common pitfalls:

- Misunderstanding when the clock starts: Many assume the countdown begins when injuries are discovered. In most cases, it begins on the date of the crash or the date of death.

- Confusing insurance deadlines with lawsuit deadlines: Policies require prompt notice, and late reporting can trigger denials even if you still have time to sue.

- Delaying legal action during settlement talks: Negotiations do not pause the statute of limitations. If the deadline passes, the court will dismiss your case.

- Relying on verbal agreements: Insurers may suggest a settlement without written proof but later deny liability. Only a filed lawsuit protects your rights.

Even one of these mistakes can permanently block recovery. Acting early and understanding the rules keeps your claim intact.

Does Comparative Fault in Nevada Affect Filing Deadlines?

In Nevada, comparative fault does not extend or shorten filing deadlines. You still must bring your lawsuit within the statute of limitations, even if responsibility is shared. A partial fault may reduce compensation, but it does not alter the filing window.

Overview of Modified Comparative Negligence Rule

Under Nevada’s modified comparative negligence rule (NRS 41.141), you can recover damages if you are 50% or less at fault, but your share of blame reduces your award. At 51% or more, you cannot recover at all.

For example, if you’re awarded $100,000 but found to be 25% at fault, you would receive $75,000 after deducting the 25% from the total settlement. If you’re even 51% at fault, you do not recover any damages.

Fault Sharing and Its Legal Impact on Deadlines

Fault disputes don’t alter Nevada’s strict filing limits, but they can eat into the time you have left to sue. For example, a victim found 30% at fault can still recover reduced damages, while someone at 60% fault recovers nothing. Because fault assignments may take months, gathering evidence quickly is critical to avoid losing both time and leverage.

How Nevada Car Accident Laws Affect Claim Timelines

Nevada car accident laws establish the framework for when and how claims are processed. Beyond the statute of limitations, Nevada’s mandatory insurance coverage and reporting requirements also affect when and how claims are processed. These obligations do not extend deadlines, but they define when the legal clock starts and how claims are preserved.

Reporting Requirements After a Crash

Accident reporting is required in Nevada, but it is separate from the statute of limitations. You must follow Department of Motor Vehicles (DMV) rules and your insurance policy’s notice provisions, even if you never file a lawsuit. Failing either can jeopardize your rights.

DMV and Insurance Reporting Deadlines

The DMV requires drivers to submit a Nevada SR-1 accident report within 10 days if police did not investigate and the crash involved:

- Injury or death, or

- Property damage of $750 or more

Penalties for failing to report include:

- Driver’s license suspension

- Vehicle registration suspension

- Additional fines under Nevada law

Insurance carriers, meanwhile, typically require notice to be given “promptly” or “as soon as practicable.” Delayed reporting often leads to denial of coverage, even if you are still within Nevada’s legal filing period.

Legal Triggers That Activate the Limitation Period

The statute of limitations begins when a legally recognized injury or loss occurs. Common triggers include:

- Date of the accident for personal injury claims

- Date of death for wrongful death actions

- Date of discovery for hidden property damage

- 18th birthday for minors, with two years thereafter

- Restoration of legal capacity for incapacitated victims

Understanding which event starts the clock ensures you don’t miscalculate the time left to sue.

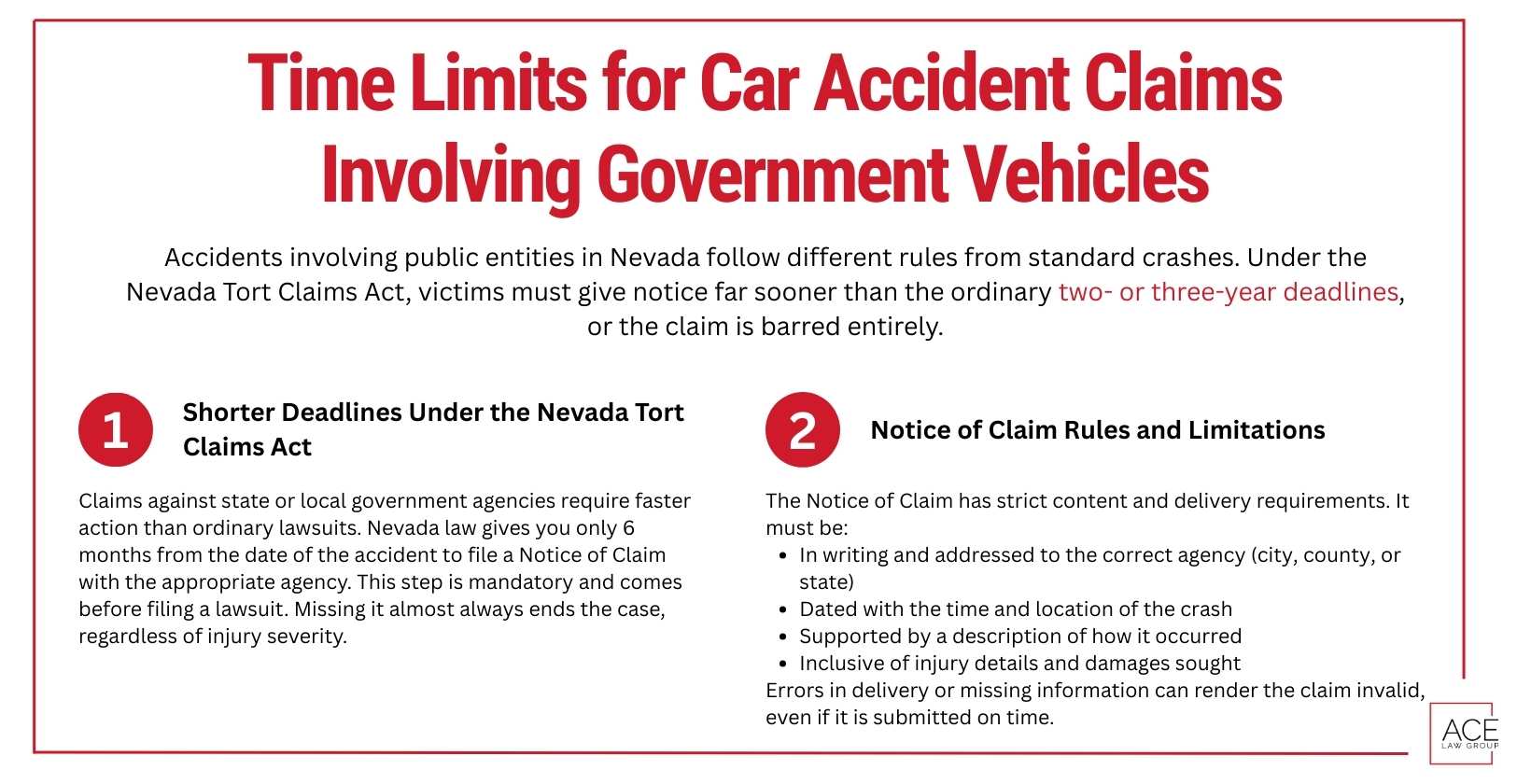

Time Limits for Car Accident Claims Involving Government Vehicles

Accidents involving public entities in Nevada follow different rules from standard crashes. Under the Nevada Tort Claims Act, victims must give notice far sooner than the ordinary two- or three-year deadlines, or the claim is barred entirely.

Shorter Deadlines Under the Nevada Tort Claims Act

Claims against state or local government agencies require faster action than ordinary lawsuits. Nevada law gives you only 6 months from the date of the accident to file a Notice of Claim with the appropriate agency. This step is mandatory and comes before filing a lawsuit. Missing it almost always ends the case, regardless of injury severity.

Notice of Claim Rules and Limitations

The Notice of Claim has strict content and delivery requirements. It must be:

- In writing and addressed to the correct agency (city, county, or state)

- Dated with the time and location of the crash

- Supported by a description of how it occurred

- Inclusive of injury details and damages sought

Errors in delivery or missing information can render the claim invalid, even if it is submitted on time.

How Insurance Deadlines Differ from Legal Filing Deadlines

Insurance reporting rules and Nevada’s lawsuit deadlines are separate systems. Policies usually require notice immediately or within a reasonable time, while state law sets strict statutes of limitations for lawsuits. Missing either can undermine your case, but for different reasons.

Why Insurance Deadlines Are Not the Same as Legal Filing Deadlines?

Insurance deadlines protect the carrier’s right to investigate, while legal deadlines preserve your right to sue. One comes from your policy contract, the other from Nevada law.

| Deadline Type | Source | Typical Requirement | Consequence (if Missed) |

|---|---|---|---|

| Insurance deadline | Policy terms | “Prompt notice” (days or weeks) | Claim denial or loss of coverage |

| Lawsuit deadline | Nevada statutes | 2 years for injury, 3 years for property | Court dismissal, no right to sue |

How Insurance Investigations Affect Filing Time

Insurance reviews can take months, but they do not pause Nevada’s statute of limitations. For example, a claim may remain open for 11 months while adjusters investigate, yet the two-year lawsuit clock continues to run. If you wait until the review ends, you may find your lawsuit window nearly gone.

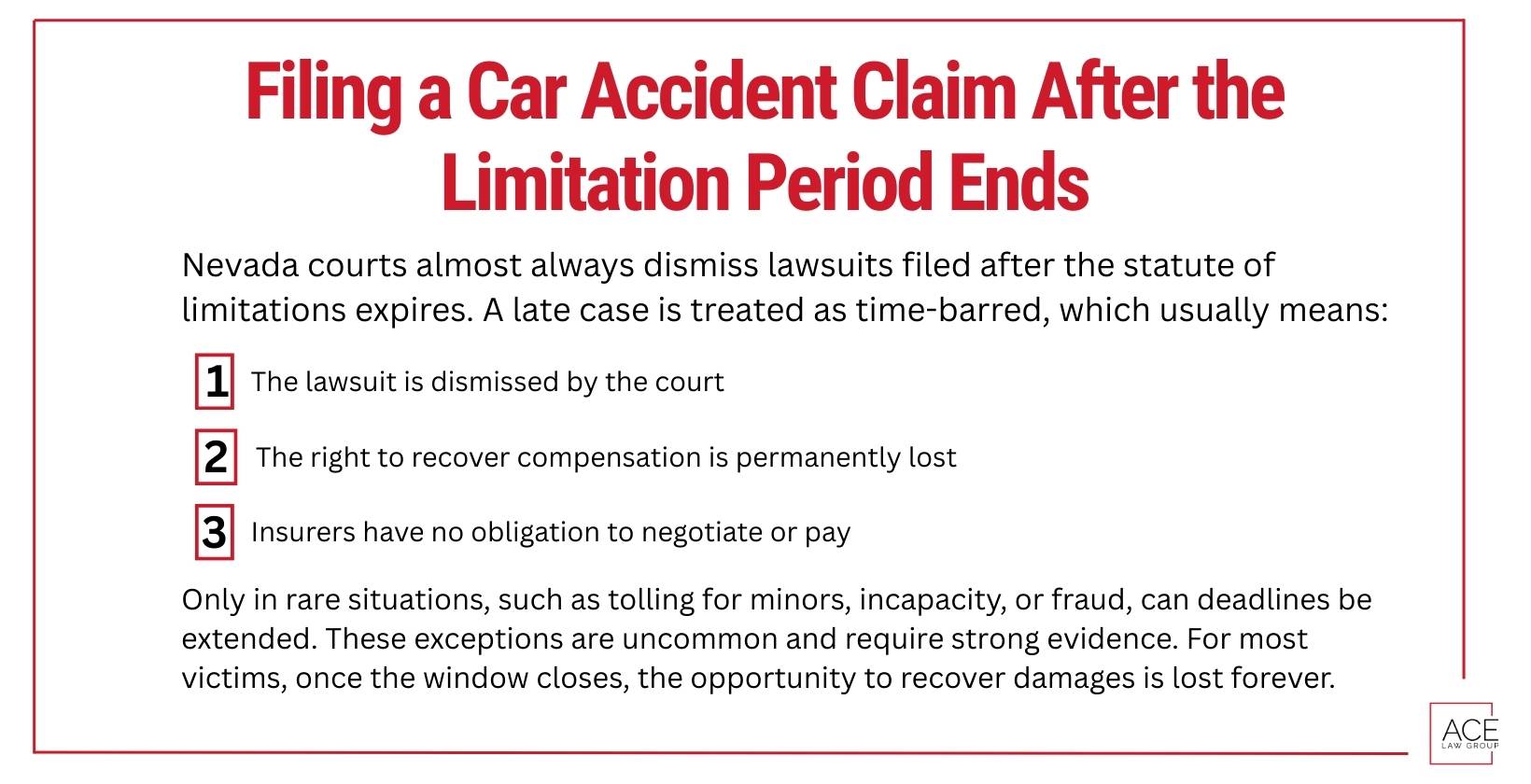

Filing a Car Accident Claim After the Limitation Period Ends

Nevada courts almost always dismiss lawsuits filed after the statute of limitations expires. A late case is treated as time-barred, which usually means:

- The lawsuit is dismissed by the court

- The right to recover car accident compensation is permanently lost

- Insurers have no obligation to negotiate or pay

Only in rare situations, such as tolling for minors, incapacity, or fraud, can deadlines be extended. These exceptions are uncommon and require strong evidence. For most victims, once the window closes, the opportunity to recover damages is lost forever.

Car Accident Resources

How to Get Access to a Car Accident Report in Las Vegas?

Car Accident Determining Fault By Location of Damage

Recovering Lost Wages After a Car Accident in Las Vegas

Are Car Accident Insurance Settlements Taxable?

How to Settle a Car Accident Claim Without a Lawyer?

Causes of Car Accidents in Las Vegas

What Happens If You Total a Leased Car in Nevada?

FAQs About the Statute of Limitations in Nevada Car Accidents

Can I file a car accident claim after partial recovery?

Yes, you can file a car accident claim after partial recovery. Filing is allowed as long as the lawsuit is submitted within Nevada’s 2-year statute of limitations for personal injury claims.

Do I need a police report to file within the deadline?

No, you do not need a police report to file a car accident lawsuit within the deadline. It is not mandatory, but it is strong evidence that supports your car accident claim in Nevada.

What if the driver left Nevada after the accident?

If the driver left Nevada after the accident, the statute of limitations may be tolled. Tolling pauses deadlines until the driver returns, preventing them from avoiding a lawsuit simply by leaving the state.

Can medical delays affect the time to file?

No, medical delays cannot affect the time to file a car accident lawsuit in Nevada. The statute of limitations starts on the accident date, not when treatment begins or medical issues worsen.

Can multiple deadlines apply to the same crash?

Yes, multiple deadlines can apply to the same crash. A personal injury claim has a 2-year limit, property damage has 3 years, and claims against Nevada government agencies must be filed within 6 months.

What if I found out later that the accident caused injury?

If you found out later that the accident caused injury, Nevada’s discovery rule may apply. This rule starts the 2-year statute of limitations on the date the hidden injury is reasonably discovered.

Are there different deadlines for out-of-state drivers?

No, there are no different deadlines for out-of-state drivers. Nevada’s 2-year limit for injury, 3-year limit for property damage, and 2-year limit for wrongful death apply equally to all accidents in the state.

Why Knowing Nevada’s Legal Time Limits Matters After a Crash

Awareness of Nevada’s statutes of limitations protects your ability to pursue compensation and avoids unintentional forfeiture of claims. By understanding when the clock starts and which deadline applies, victims can prepare evidence effectively and safeguard their rights under state law.

However, knowing the deadlines and successfully applying them to your case are two different challenges. Even one missed filing date can permanently bar your right to recovery. Insurance companies also use delay tactics, hoping victims wait too long to act.

That’s why working with an experienced Las Vegas car accident lawyer is essential. At Ace Law Group, our attorneys know how Nevada’s legal time limits affect personal injury and wrongful death claims. We move quickly to preserve evidence, ensure your case is filed on time, and protect you against insurer strategies designed to minimize or deny compensation.

If you or a loved one has been injured in a crash, don’t let Nevada’s strict deadlines put your case at risk. Contact Ace Law Group today to schedule a free consultation with a skilled Nevada personal injury attorney and safeguard your right to full compensation.