After a car accident, you’re likely left dealing with medical bills, vehicle repairs, and endless insurance questions. Who pays for the damages? What if the other driver is uninsured? How do you make sure the insurance company treats you fairly? Understanding how insurance works in Las Vegas car accident claims can help you avoid costly mistakes and secure the compensation you deserve.

In this blog, we’ll break down Nevada’s auto insurance laws, key coverage types, and the step-by-step process of filing a claim. We’ll also cover common mistakes, challenges you might face, and when legal help can maximize your settlement.

Recent Case Result

We secured a $4.8 Million settlement for a client injured in a car crash.

Our legal team fought to recover full compensation for medical expenses, lost wages, and pain and suffering.

Call Us Now: (702) 333-4223Inside Nevada’s Auto Insurance: Laws, Limits, and Claims

Nevada follows specific auto insurance rules that impact how claims are handled after an accident. Whether you’re dealing with an at-fault driver, filing a claim with your own insurer, or unsure what coverage applies, knowing the state’s laws can help you take the right steps.

What are Insurance Claims?

An insurance claim is a formal request for compensation after an accident. If you’re injured or your car is damaged, you file a claim with the at-fault driver’s insurance or your own provider, depending on your coverage type. The insurer then investigates the claim and determines how much they’ll pay based on the policy terms.

At-Fault vs. No-Fault in Nevada

Nevada is an at-fault state, meaning that the person responsible for the accident is liable for the damages. This differs from no-fault states, where each driver’s insurance covers their own damages regardless of who caused the accident. In Nevada, determining fault is crucial because it affects who pays for the damages. If you’re not at fault, the other driver’s insurance should cover your expenses. However, proving fault can be challenging, and it’s wise to consult with a legal expert to ensure your rights are protected.

Nevada’s Minimum Insurance Requirements

To drive legally in Nevada, you must carry at least:

- $25,000 per person for bodily injury

- $50,000 per accident for bodily injury

- $20,000 for property damage

These required insurance subcategories might not cover all costs in a serious accident, so many drivers opt for higher coverage.

Key Auto Insurance Coverages

Auto insurance includes several types of coverage that can protect you after an accident. Here are the key options available in Nevada:

Liability Coverage (Bodily Injury & Property Damage)

Covers injuries and damages you cause to others in an accident. It doesn’t pay for your injuries or car repairs.

Uninsured/Underinsured Motorist Coverage

Protects you if you’re hit by a driver with no insurance or not enough policy coverage to pay in full for your losses.

Collision & Comprehensive Coverage

- Collision: Pays for repairs to your car after an accident, regardless of fault.

- Comprehensive: Covers damage from theft, vandalism, natural disasters, or hitting an animal.

Medical Payments (MedPay) Coverage

Covers medical bills for you and your passengers, no matter who’s at fault.

Full Coverage Insurance Options

A combination of liability, collision, comprehensive, and MedPay to provide broader protection.

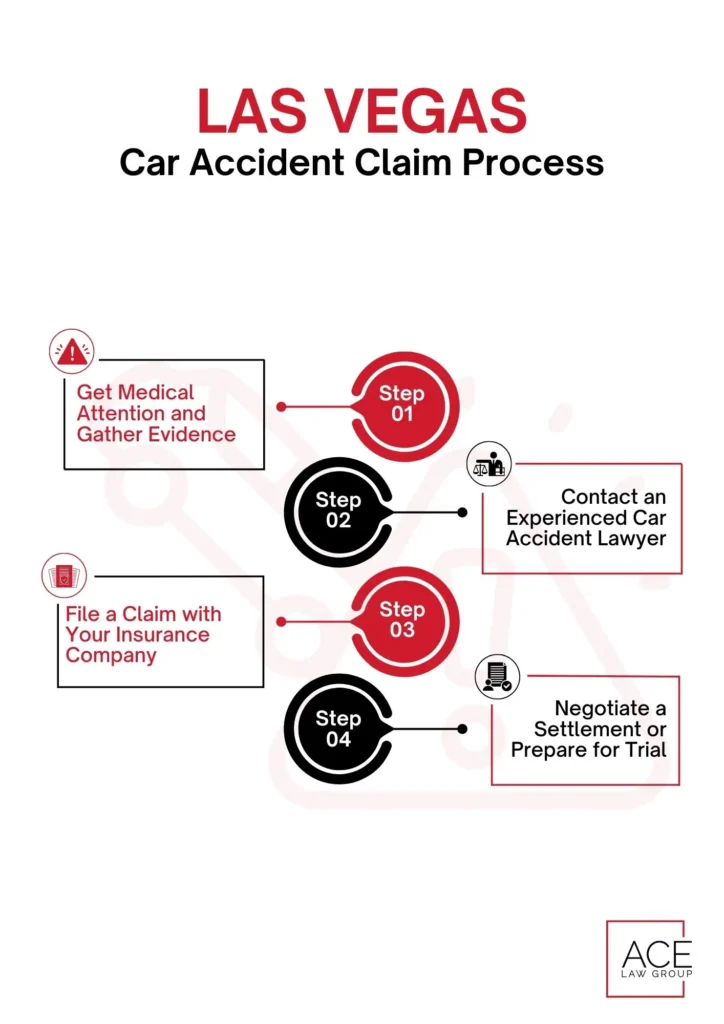

Filing Your Car Accident Claim: A Clear, Step-by-Step Process

Filing a car accident claim can be a challenging task, but understanding the steps involved can make the process smoother and less stressful. Here’s a clear, step-by-step guide to help you through filing your car accident claim.

Immediate Post-Accident Actions

Ensure Safety & Seek Medical Help

Your safety and health are the top priorities. If you’ve been involved in a car accident, the first step is ensuring everyone involved is safe. If anyone is injured, seek medical help immediately. Even if injuries seem minor, it’s important to get checked out by a medical professional. Some injuries may not be immediately apparent and can worsen over time.

Report the Accident

If the accident involves injuries or significant property damage, you should report it to the police. They will create an official accident report, which can be crucial evidence when filing your claim. Make sure to get a copy of the police report for your records.

Document the Scene

Gather as much information as possible at the scene of the accident. Take photos of the vehicles involved, the surrounding area, and any visible injuries. Exchange contact and insurance information with the other driver. If there are witnesses, get their contact information as well. This documentation can prove invaluable in properly supporting your claim.

Initiating Your Claim

Notify Your Insurance Provider

Notify your insurance provider about the accident as soon as possible. Most insurance policies require you to report the incident within a certain timeframe. Provide them with the accident details, including the date, time, location, and any injuries involved.

Organize Your Documentation

Gather all the documentation related to the accident. This includes the police report, medical records, photos, and any other evidence you collected. Keep all these documents organized and easily accessible. This will make it easier for you and your insurance provider to process the claim efficiently.

Handling the Investigation & Negotiation

Engage with Your Insurance Adjuster

Your insurance provider will assign an adjuster to your case. The adjuster will investigate the accident and assess the damages. Cooperate fully with the adjuster, but also remember that you have the right to seek legal advice if needed. A Las Vegas car accident lawyer can help ensure your rights are protected throughout the process.

Understand the Claims Evaluation & Fault Determination Process

The insurance adjuster will evaluate your claim based on the evidence and determine who is at fault for the accident. This process can involve reviewing police reports, witness statements, and other documentation. Understanding how this process works can help you anticipate potential issues and prepare accordingly.

Manage Settlement Discussions

Once the investigation is complete, the insurance provider will make a settlement offer. It’s important to carefully review any settlement offer line by line and consider whether it fully covers your damages and expenses. If you feel the offer is insufficient, you can negotiate for a fairer amount. A Las Vegas car accident attorney can guide you through these discussions, ensuring you receive the deserved compensation.

Common Mistakes to Avoid When Filing a Claim

Filing a car accident claim can be complex, and a simple process mistake can negatively impact the outcome. Here are some key missteps to avoid to ensure your claim is handled smoothly and fairly.

Failing to Report the Accident Promptly

One common mistake people make is waiting too long to report the accident to their insurance provider. Your policy may require you to report an accident within a certain time frame. Delaying this step can lead to claim denials or reduced settlements.

Inadequate Documentation and Evidence Gathering

Without proper documentation, it’s difficult to support your claim. Collect as much evidence as you can at the scene of the accident—photos, witness statements, medical records, and any other relevant documents. The more information you have, the stronger your claim will be.

Misunderstanding Your Policy Coverage

Understanding your insurance policy is crucial. Many people don’t fully review their coverage, leading to misunderstandings about what’s included. Review key aspects like medical payments and uninsured motorist coverage to know everything is covered. If you have questions, contact your insurance provider for clarification.

Settling Claims Too Quickly

It can be quite tempting to accept the first offer from the insurance company, but that initial offer is often not enough to cover all your expenses, especially if you have ongoing medical treatments or repairs. Many people settle quickly because they’re eager to move on. Insurance companies know this, so they may offer a low settlement to take advantage of that urgency. It’s important to take your time to carefully and thoroughly assess the damages and future costs before agreeing to a settlement.

Ignoring Professional or Legal Advice

Many people think they can handle a car accident claim on their own, but insurance companies are often more concerned with minimizing payouts than protecting your best interests. Consulting with a car accident lawyer can help you get your justly deserved compensation.

Overcoming Common Insurance Challenges

When filing a car accident claim, you may face several common challenges that can complicate the process, such as delays, denials, or disagreements about who’s at fault. Understanding how to handle these obstacles can help you address and manage the claims process more effectively. Let’s explore some of these items in more depth.

Delays, Denials, and Disputes Over Fault

One of the biggest pitfalls people face after a car accident is dealing with delays or denials from insurance companies. Insurers may try to avoid paying out settlement sums by disputing who’s at fault. These stall tactics can leave you feeling frustrated and unsure about how to proceed. It’s important to stay organized, keep track of all information and developments, and follow up regularly. If needed, you may have to take legal action to ensure you get the compensation you deserve.

Dealing with Underinsured Drivers & Financial Losses

What happens if the driver at fault doesn’t have enough insurance to cover your damages? This can be an incredibly stressful situation, especially if you’ve incurred significant medical bills and vehicle damage. You may need to use your uninsured/underinsured motorist coverage to cover the expenses. If you don’t have this coverage, or if it’s insufficient, you may have to explore other options like suing the at-fault driver personally.

When & How Legal Help Can Maximize Your Claim

Knowing when to seek legal help can significantly enhance your car accident claim. Legal assistance can provide valuable guidance and support, ensuring you receive the merited compensation amount. Let’s look at some key indicators that the timing is right i to consult a lawyer, and how an attorney can be of help.

Signs You Need a Lawyer

There are times when handling a car accident claim on your own just isn’t enough. If you encounter any of the following situations, it might be time to consult with a lawyer:

- The insurance company is unresponsive, uncooperative, or delaying your claim.

- You’re facing significant medical bills that aren’t being covered.

- There’s a dispute or gray area over who is at fault, or liability is unclear.

- You’re not getting the compensation amount that you feel you deserve.

How an Attorney Can Enhance Your Settlement

A skilled attorney can help you achieve a better settlement for your car accident claim. Here’s are the benefits of car accident lawyer:

- Expert negotiation: Lawyers have experience negotiating with insurance companies to secure a higher settlement.

- Thorough documentation: They assist in gathering and completing all the necessary paperwork to support your case.

- Accurate damage assessment: Attorneys help identify the full extent of your damages, including pain and suffering.

- Maximize compensation: A lawyer ensures that you’re fully compensated for medical bills, lost wages, and other costs.

Conclusion

Dealing with a car accident insurance claim in Las Vegas can be stressful, but understanding the process and common pitfalls can help you get the compensation you deserve. If you encounter delays, disputes, or insufficient coverage, consulting with an experienced car accident attorney can help ensure a fair outcome. Protect your rights and seek professional advice from a qualified and proven Las Vegas car accident attorney to increase your chances of a successful settlement.

FAQs About How Insurance Works in Las Vegas Car Accident Claims

In Nevada, an insurance company has 30 days to investigate a claim and determine whether it is valid.

It typically takes a few weeks to a few months to settle a car accident claim in Nevada, depending on the complexity of the case and the parties involved.

If your car is totaled, insurance will pay the actual cash value (ACV) of your vehicle, which is the replacement cost minus depreciation.

Full coverage includes liability, collision, and comprehensive coverage, while minimum coverage only meets the state’s required liability limits for bodily injury and property damage.

No, personal injury protection (PIP) is not required in Nevada, but it is available as an optional coverage.

Under Nevada’s comparative negligence law, if you are partially at fault for the accident, your compensation will be reduced by your percentage of fault.

If the at-fault driver is uninsured, you can file a claim with your own uninsured motorist coverage if you have it, or pursue legal action against the driver.

Yes, you can sue the at-fault driver for damages if the insurance settlement does not fully cover your losses.

Consult Ace Law Group for Legal Support

Handling insurance claims after a car accident can be daunting and confusing. If you need help understanding your rights and ensuring you receive fair compensation, contact Ace Law Group for a free consultation. Our experienced car crash attorneys will guide you through the process and help you secure the best possible outcome. Don’t hesitate—schedule your free consultation today.