Your car accident settlement is taking so long because insurance companies, medical providers, and Nevada law each control parts of the process that move at different speeds. In Nevada, delays often occur when insurers wait for complete medical documentation, clarification of liability under comparative negligence rules, or final confirmation of your Maximum Medical Improvement (MMI) before calculating damages.

Other common causes include multi-party crashes, subrogation claims, or delays in obtaining police reports and verifying policy limits. Each of these steps adds review time, especially in high-value or disputed cases.

Settlement delays aren’t always negative; they often mean your attorney, insurer, or doctor is ensuring every injury and cost is accurately documented under Nevada’s personal injury laws. Understanding these factors helps you anticipate timelines, avoid unnecessary setbacks, and stay informed throughout your claim.

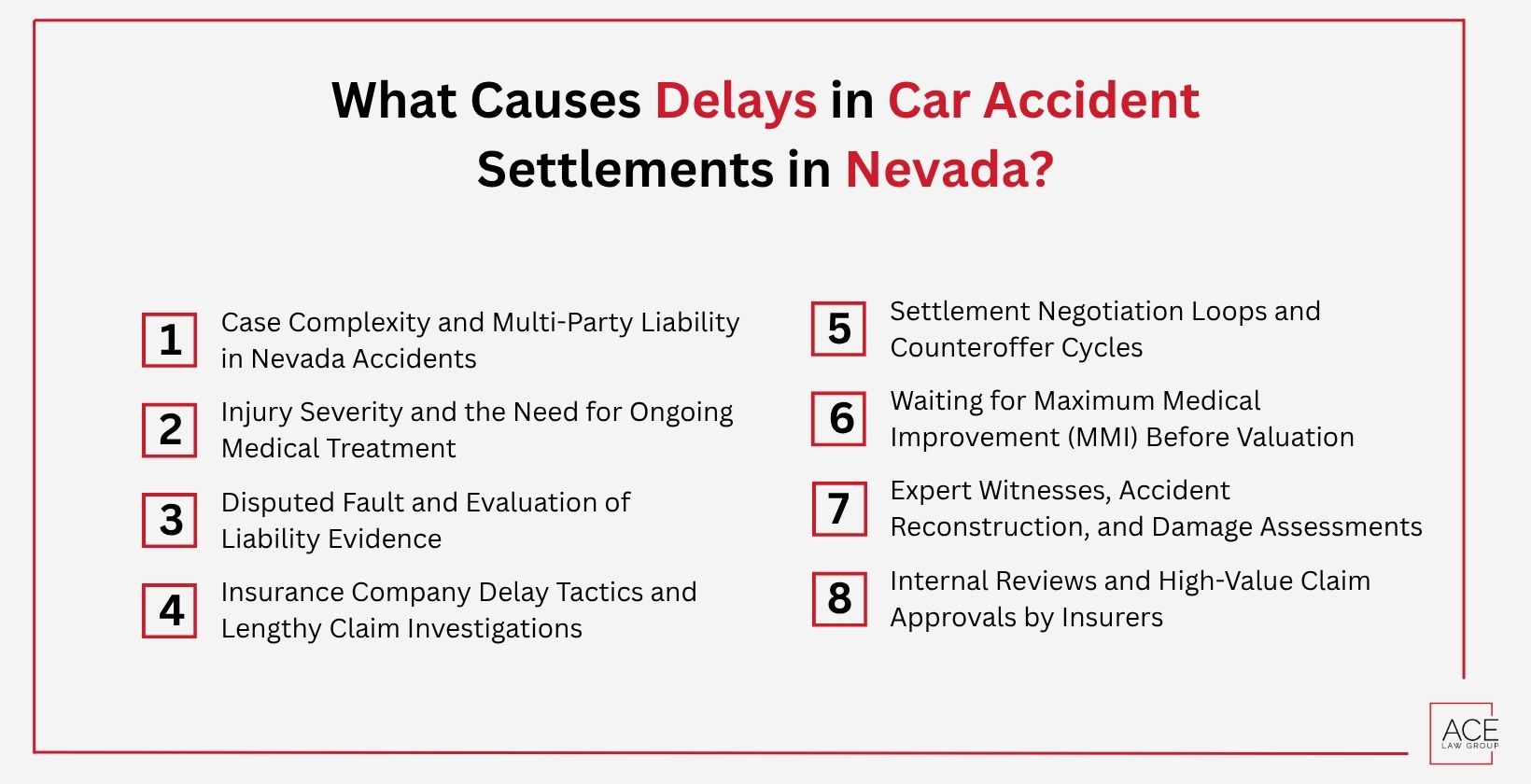

What Causes Delays in Car Accident Settlements in Nevada?

Delays are common in Nevada car accident claims, but not every delay is a bad sign. Some are part of the normal injury claim timeline, like reaching maximum medical improvement or reviewing fault evidence. Others, for example, insurer’s delay tactics or unclear case updates, signal red flags. Each of these extends time or pauses the process differently.

To understand what’s normal and what isn’t, let’s look at the eight most common causes of car accident settlement delays:

1. Case Complexity and Multi-Party Liability in Nevada Accidents

Not every traffic accident in Nevada is a collision of two cars. Many delays happen when the crash involves more than one driver, multiple insurance policies, or unclear fault. Think of chain-reaction crashes on I-15, rideshare accidents with commercial policies, or collisions at busy Las Vegas intersections where everyone points fingers. If more than one driver is partly at fault, Nevada’s modified comparative negligence rules come into effect, further complicating things.

Proving liability in these complex accident cases takes longer to resolve, for several reasons: they require investigators to sort through multiple statements, review overlapping insurance coverages, and assess shared fault.

2. Injury Severity and the Need for Ongoing Medical Treatment

The more severe your injury, the longer it will take to settle. That’s because insurers can’t fully calculate the claim’s value until doctors confirm your condition is stable and unlikely to change.

Serious car accident injuries like chronic pain, organ damage, or long-term disability often require ongoing medical treatment, additional documentation, and expert input. All of which slows down the settlement process. Settling too soon, while still recovering and before expenses are final, risks underpayments that won’t cover future care.

3. Disputed Fault and Evaluation of Liability Evidence

When the fault isn’t clear, expect delays. Fault disputes occur when drivers, insurers, or both argue over who’s responsible for the crash. This is common in intersection crashes, lane-change collisions, or when multiple cars are involved.

Insurers won’t move forward until they’ve reviewed every piece of liability evidence. That includes the police report, witness statements, surveillance footage, dashcam clips, and physical damage photos. If the evidence is incomplete or contradictory, the investigation takes even longer.

4. Insurance Company Delay Tactics and Lengthy Claim Investigations

With the goal of reducing their financial obligations, insurance companies willingly use delay tactics to stretch the timeline. Common insurance company delay tactics include:

- Requesting more time to investigate the claim

- Questioning evidence credibility or demanding unnecessary documents

- Offering low settlements to pressure quick acceptance

- Leaving the claim “under review” and being unresponsive to inquiries

These bad-faith stall tactics aren’t illegal by default, but they’re often designed to wear you down or delay payment.

Learn how insurance works in Las Vegas car accident claims.

5. Settlement Negotiation Loops and Counteroffer Cycles

The endless back-and-forth begins once you send a settlement demand. The insurance company rarely accepts the initial amount and usually responds with payouts below average. Your Las Vegas car accident lawyer reviews it and pushes back, and the negotiation loop continues.

This counteroffer cycle can repeat multiple times, especially in high-value car accident claims or cases with unclear damages. Each round involves valuation reviews, approval delays, and insurer risk assessments. If there’s a big gap between both sides’ numbers, progress slows even more.

6. Waiting for Maximum Medical Improvement (MMI) Before Valuation

Insurers and attorneys won’t finalize the case value until you’ve reached Maximum Medical Improvement (MMI). This is the stage when doctors confirm that your condition has stabilized and further recovery or worsening is not likely.

Waiting till the MMI result matters because settling early on means predicting future medical costs and potentially making the wrong guess. If you accept an offer too early and your condition worsens later, you won’t be able to reject it or ask for extra. Until MMI, your case waits. This delay is not an unnecessary one; it protects your future compensation.

7. Expert Witnesses, Accident Reconstruction, and Damage Assessments

Some car accident cases need more than just medical records and a police report. When liability is unclear or injuries are severe, your attorney may bring in expert witnesses like accident reconstruction specialists, medical experts, or economic analysts. These professionals help clarify what happened, how badly you were hurt, and what your future costs might be.

Scheduling evaluations, reviewing evidence, and compiling expert findings take time. But these steps significantly increase the value and credibility of your car accident claim.

8. Internal Reviews and High-Value Claim Approvals by Insurers

High-value claims, those involving catastrophic injuries, long-term financial impact, or substantial property damage, don’t get approved easily. These cases go through multiple levels of internal reviews, double checks, and lengthy evidence verifications. If anything looks incomplete or inconsistent, they demand clarification. It’s frustrating, but insurers treat large payouts as high-risk decisions. Until they finish reviewing, no settlement check is approved.

How Medical Evidence and Documentation Impact Settlement Timelines in Nevada

The pace of the claim and the final value both depend on the completeness, credibility, and admissibility of the different types of evidence. Medical documentation that links the injury to the accident is the primary determinant that fluctuates the claim timeline. Here’s how:

Missing or Incomplete Medical Records Delay Claim Evaluation

Every injury, treatment, diagnosis, and prognosis must be backed by time-stamped, itemized medical documents. Insurers can’t fully evaluate the case without a clear medical timeline. These gaps give them reasons to question the severity of the injury, the cause, or the necessity of treatment. When there are missed visits, delayed treatment, or missing records, your claim stalls and takes longer to resolve.

How Independent Medical Examinations (IMEs) Can Stall Your Settlement

When the insurance company disagrees with your doctor’s diagnosis or questions the extent of your injuries, they may request an Independent Medical Examination (IME). Insurers schedule examiners to produce reports and review and compare them against your existing medical records. This process, on average, takes 6 or more weeks. If the IME doctor downplays your injuries or offers a conflicting opinion, expect more delays. IME is rarely for your benefit. It’s a tool insurers use to challenge claims and slow the process.

How Fault Determination and Police Reports Contribute to Settlement Delays

Fault isn’t always obvious, and determining who caused the crash can be one of the biggest reasons a settlement stalls. Insurance companies need reliable, consistent evidence before they’ll move forward with liability decisions. That usually starts with police reports, witness statements, and crash scene documentation.

Here’s how specific issues in the evidence process cause delays.

Delays in Accessing or Correcting Nevada Police Accident Reports

Insurance companies rely heavily on the police report to guide liability decisions. Getting that official report isn’t always quick. Some law enforcement agencies take weeks to release it, especially in Las Vegas, where accident volume is high.

Even when the report is available, errors or missing information can slow things down. If you or your Las Vegas motor vehicle attorney has to request a correction or clarification, the back-and-forth with the department adds more time. Insurers often pause claim evaluations entirely until they have a final, accurate report on file.

Conflicting Witness Statements Extend Liability Determination

When eyewitnesses offer different versions of the same crash, insurance adjusters slow down and dig deeper. It’s common in multi-party accidents or when crashes happen in busy intersections without clear visual evidence. The more inconsistent the testimony, the longer it takes to determine fault, and until that happens, your settlement won’t proceed.

How Third Parties and Subrogation Claims Delay Nevada Settlements

Sometimes it’s not just you and the other driver. Third-party interests, like your health insurer or another liable party, can get involved and create extra layers of delay. These entities often have financial stakes in your compensation and must be resolved before any money reaches you. Two of the most common delay reasons are:

Health Insurance Subrogation Claims Must Be Resolved Before Payout

If your health insurance paid for your accident-related medical care, it may have a subrogation claim, a right to be reimbursed from your settlement. Before you get your check, your attorney has to negotiate repayment amounts, validate billing records, and reach a final agreement with the insurer. This may take weeks, especially when dealing with hospital liens, multiple providers, or large treatment costs.

Coordination Between Multiple Insurers Slows Down Final Disbursement

When more than one insurance policy is involved, such as in multi-vehicle collisions, employer-related crashes, or underinsured motorist (UIM) claims, final payouts stretch longer. Each insurer needs to confirm coverage, assign liability percentages, and agree on contribution amounts. Every insurer works on its own timeline, and some dispute how much they owe.

How Economic and Non-Economic Damage Assessments Affect Timeline Length

Crash victims may recover multiple types of damages, including economic losses and non-economic damages. Economic losses in car accident claims, like medical bills and lost wages, are easier to calculate. But non-economic damages, like pain and suffering, are subjective and follow complex evaluation rules that take more time to finalize. This takes a longer duration because:

Projecting Future Medical Costs Extends the Settlement Process

When recovery is still ongoing, or doctors anticipate future treatment, the claim must include projected medical expenses. That means estimating costs for surgeries, therapy, medication, or long-term care. These projections usually require written opinions from treating physicians or medical experts. Insurers often challenge them, which leads to further document reviews or second opinions.

Pain and Suffering Calculations Require Subjective Valuation Time

Unlike a hospital bill, pain doesn’t come with a price tag. Non-economic damages, such as emotional distress, daily limitations, and lifestyle changes, therefore, take longer to negotiate. Insurers require documentation for these claims: therapist notes, personal journals, or testimony about how your injury affects daily life. Your attorney may need to substantiate the amount, which prolongs the negotiation process.

What Legal and Administrative Delays Affect Nevada Car Accident Settlements?

Most delays come from the injury or the insurance company, but some result from the legal and administrative process itself. In Nevada, court backlogs, overworked adjusters, and routine filing issues can all push your car accident settlement payout further down the timeline.

These delays aren’t always avoidable, but knowing where they come from helps you stay informed:

Court Scheduling Backlogs and Civil Case Processing Times

Nevada’s civil courts, especially in Clark County, stay overloaded. If your case moves toward litigation, you may have to wait months just to get a date.

Hearing reschedules, continuances, or trial date pushes are common. These court backlog issues don’t reflect on the strength of your case; they’re just part of the system. But they can slow progress significantly, even when everything else is ready.

Also read about car accident settlements vs. going to trial in Las Vegas.

Insurance Adjuster Caseloads and Internal Administrative Delays

Insurance adjusters often juggle hundreds of active claims. When your file lands in a queue, it may sit for weeks before getting a response. Larger insurers often route claims through multiple departments for approval. Each internal handoff, review, or supervisor sign-off adds time. These adjuster workload delays can be especially noticeable in statewide carriers handling both liability and medical review.

Filing Errors, Missing Documents, and Processing Delays

Small clerical mistakes can cause major delays. If forms are missing signatures, medical releases are incomplete, or key documents aren’t properly submitted, your claim may hit a standstill until it’s corrected. These document processing delays usually come from paperwork bottlenecks between your attorney, the insurer, or the medical provider.

Evidence Collection and Discovery Process Timelines

In legal cases, the initial evidence collection and the formal discovery phase may take several months. All involved parties must exchange evidence, submit formal requests, and sometimes conduct depositions or expert reviews. This entire process often slows cases involving disputed fault, long-term injuries, or multiple parties. Each document request or scheduling conflict adds more days, and until discovery is complete, settlement talks usually stay on hold.

Delays in Obtaining and Verifying Medical Records

Even when treatment is finished, getting full medical records can take weeks. Hospitals and clinics often process these requests slowly, especially if they use third-party vendors.

Once received, records still need to be reviewed, verified, and cross-checked with billing or prior documentation. If anything’s missing or unclear, the process restarts. These medical record verification delays are very common and mostly outside your control.

Why Do Car Accident Settlement Payments Still Take Time After Agreement in Nevada?

Even after the case reaches resolution, the settlement check doesn’t arrive right away. The final steps before the release of payment include signing legal documents, clearing liens, processing payments, and handling attorney trust procedures.

None of these steps is optional, and here’s how each one works:

Settlement Release Forms and Final Approval Processes

Before payment is processed, you must sign a settlement release form. This legal document confirms that you agree to the terms and will not pursue further claims against the at-fault party. Your attorney will review it, verify the terms, and return it to the insurer. Only after that can the insurance company begin the payment process. If anything is missing, like signatures or approvals, the payment gets delayed.

Why Insurance Check Processing Adds Additional Delays

Insurance companies rarely issue checks immediately after they approve the claim. Many use internal accounting systems, multi-level authorization processes, or external vendors for disbursements, leading to additional delays. Your payment might be in a queue or awaiting final approval from the finance department. Some insurers also process checks in scheduled batches, which means your claim could be held until the next payment cycle.

Attorney Trust Accounts: How Funds Are Managed and Disbursed

In Nevada, attorneys must deposit settlement funds into a client trust account before disbursing them. This ensures the money clears, liens are resolved, and proper accounting is done. The process includes bank clearance, IOLTA account verification, and reconciliation of all related costs. Only after that will your lawyer issue your portion of the check. This is usually for safeguarding your funds rather than a planned delay tactic.

Unresolved Medical Liens and Outstanding Bills

If you received treatment on a lien basis or if your health insurer covered your bills, you must settle those amounts before receiving payment. Your attorney will negotiate with providers, confirm balances, and issue payments to hospitals or clinics. This lien resolution step protects you from future billing or double payment issues, but its duration can add days or weeks, depending on how quickly providers respond.

How Long It Takes to Actually Receive a Settlement Check in Nevada

Most Nevada clients receive their check within 4 to 8 weeks after signing the release form. Timing depends on how fast the insurer processes payment, how long the bank takes to clear the check, and whether there are any remaining liens or billing issues.

Staying in touch with your attorney and promptly returning all paperwork helps speed things up. Delays usually happen when one of those final steps takes longer than expected.

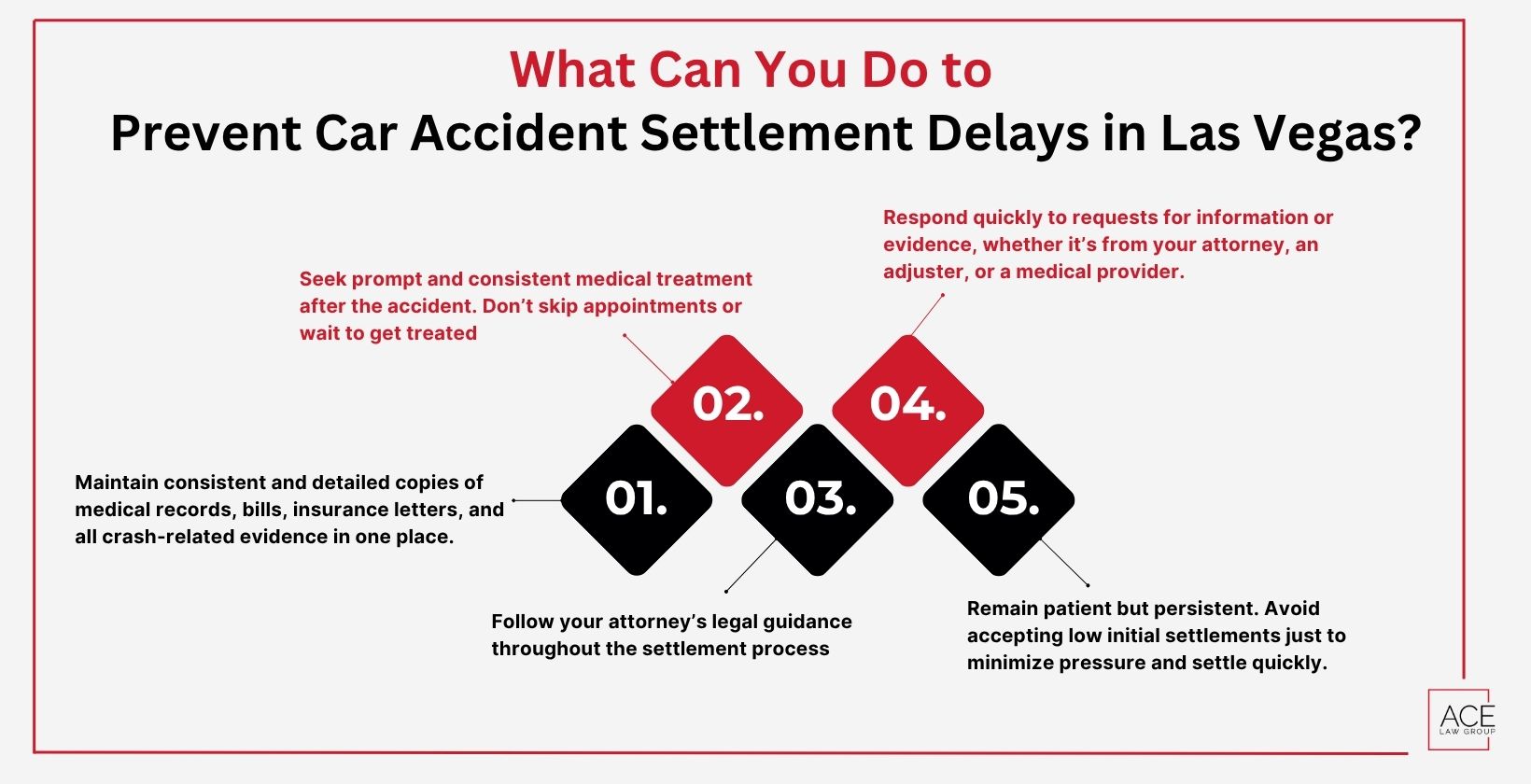

What Can You Do to Prevent Car Accident Settlement Delays in Las Vegas?

You can’t control court calendars or aggressive insurance tactics. What you can do is take informed and strategic steps that keep your case progressing:

- Maintain consistent and detailed copies of medical records, bills, insurance letters, and all crash-related evidence in one place.

- Seek prompt and consistent medical treatment after the accident. Don’t skip appointments or wait to get treated.

- Follow your attorney’s legal guidance throughout the settlement process

- Respond quickly to requests for information or evidence, whether it’s from your attorney, an adjuster, or a medical provider.

- Remain patient but persistent. Avoid accepting low initial settlements just to minimize pressure and settle quickly.

The takeaway: Staying organized, responsive, and medically consistent prevents most settlement delays and helps you recover every type of compensation you deserve without unnecessary setbacks.

Does Nevada Law Set Deadlines for Settlement Payouts?

Nevada law doesn’t set one fixed deadline for all settlement payouts, but it does require that payments be made promptly and fairly within a “reasonable time” (generally 15 to 60 days after you sign a release form). If they delay beyond that without a good reason, it may qualify as bad faith, giving you the right to take legal action through a bad-faith lawsuit.

How Insurance Policy Limits and Coverage Types Affect Payout Timelines

If the at-fault driver has a limited policy or minimal coverage, the insurer may settle quickly and pay the full limit. But if your claim exceeds that amount or involves underinsured motorist (UIM) coverage, delays are more likely.

In UIM cases, your own insurance company now becomes part of the process. That means more review, more documentation, and sometimes additional negotiations before you see a payout.

What Happens If the At-Fault Driver Is Uninsured or Underinsured in Nevada?

If the driver who hit you doesn’t have enough coverage or lacks one, you may need to file through your own uninsured/underinsured motorist (UM/UIM) policy.

This adds extra steps: evaluating your own coverage, opening a new claim, and resolving potential subrogation issues. These types of claims often involve longer timelines and more pushback from insurers, even though it’s your own policy.

Car Accident Resources

How to Get Access to a Car Accident Report in Las Vegas?

Car Accident Determining Fault By Location of Damage

Recovering Lost Wages After a Car Accident in Las Vegas

Are Car Accident Insurance Settlements Taxable?

How to Settle a Car Accident Claim Without a Lawyer?

Causes of Car Accidents in Las Vegas

What Happens If You Total a Leased Car in Nevada?

Frequently Asked Questions About Car Accident Settlement Delays in Nevada

Can accepting a quick settlement hurt my compensation in Nevada?

Yes. Accepting a quick settlement in Nevada can hurt your compensation if your injuries worsen and the final payout doesn’t include future or long-term costs. Once you sign the release, you can’t recover more later, even if new medical issues appear.

What factors cause some Nevada car accident cases to resolve faster?

Car accident cases in Nevada resolve faster when fault is clear, injuries are minor, and all documents are submitted early. Fast cooperation from insurers, doctors, and clients can significantly shorten the settlement timeline.

Does the at-fault driver’s insurer control how fast I get paid?

Yes. The at-fault driver’s insurer controls how fast payment is processed after settlement. Delays happen if they stall during investigations and evidence reviews, wait on release forms, or challenge medical expenses.

How does Nevada’s comparative negligence law affect settlement timelines?

Nevada’s comparative negligence law affects settlement timelines by requiring insurers to determine fault percentages before paying. If multiple drivers share fault, it takes longer to investigate and negotiate the final compensation breakdown.

Can I track the progress of my car accident settlement in Nevada?

Yes. To track the progress of your Nevada car accident settlement, stay in contact with your car accident attorney. They can update you on medical record status, negotiation steps, insurer response times, and any remaining delays.

Why does my lawyer need time after negotiations end?

Your personal injury lawyer needs time after negotiations end to finalize the release, verify lien amounts, process the check, and ensure ethical disbursement. This step protects you and ensures legal compliance before funds are paid out.

How long do Nevada courts take to approve a car accident settlement for minors?

Nevada courts usually take 2 to 6 weeks to approve a car accident settlement for minors. A judge must review the terms, ensure fairness, and sign off before the funds are released into a blocked account.

What happens if the insurance company delays beyond Nevada’s legal deadlines?

If the insurance company delays payment beyond Nevada’s legal deadlines without a valid cause, it may be acting in bad faith. Your attorney can file a complaint or initiate legal action to force timely payment.

What You Can Expect While Waiting for a Car Accident Settlement in Nevada

Waiting for a settlement can feel like everything’s on hold. Medical bills stack up. Updates move slowly. And each delay adds more frustration. But if you understand what’s happening behind the scenes, the process feels less uncertain.

In most cases, progress depends on timelines you can’t see, medical recovery, insurance review, or legal clearance. Staying informed, staying involved, and staying patient are your best tools while the system does what it needs to do.

If your Nevada car accident settlement is taking too long, reach out to Ace Law Group for our trusted Nevada car accident lawyer today to review your case and push for timely results. Call us at 702-333-4223 for a free consultation.